Finding the 5 best budget apps in Australia may sound easy, but trying to find the best apps to help save you money is time-consuming. First you need to find them, download them, spend the time setting everything up, and only then can you finally take the app for a ‘test drive’ and see if it actually suits you.

So let me help you save some time with this list of the best 5 budget apps in Australia for Australians.

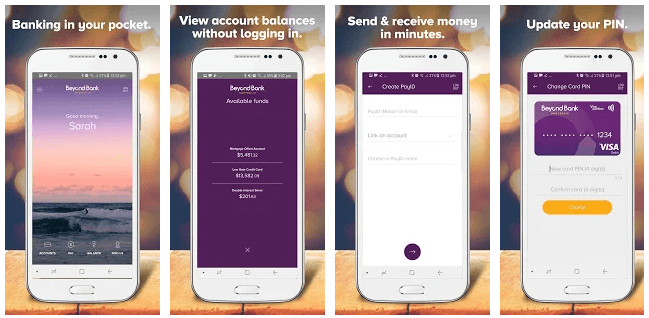

Your Bank's App

Before you roll your eyes and think “come on, Edwena, pull the other leg” the truth is that Australian banks have been leading the financial world with their online banking and budgeting apps as they all jostle for your business.

They are genuinely doing a great job of it too.

Recently at Pinpoint Finance, I helped an older couple rejig some debt to help them prepare better for retirement. Their number one request was a bank that had a great budgeting app! We presented the options and then because we don’t have demo versions of the banking apps, the husband found friends with an account at each of the banks we recommended and got them to show him how each banks mobile and budgeting app worked and before he decided which bank they would refinance their debt to. This certainly isn’t the norm but it highlights the fact that in Australia the choice of banking institution to engage with is now so great that everyone is jostling to have the additional value customers are actively seeking.

Track My Spend

This is a free app that has been developed and is available through ASCI’s website MoneySmart. It is easy to use and allows you to track your personal expenses on the go giving you a better picture of what you are spending your money on.

You can use it to record expenses such as your weekly household budget, work or travel expenses, and even those cash expenses that are difficult to record, or the costs of a one-off special event such as a major family holiday.

One of the best things about Track My Spend is their spending categories feature, where you are able to allocate whether the purchase falls into “needs” or “wants”. This helps you to identify the areas where you can rein in your spending and start saving!

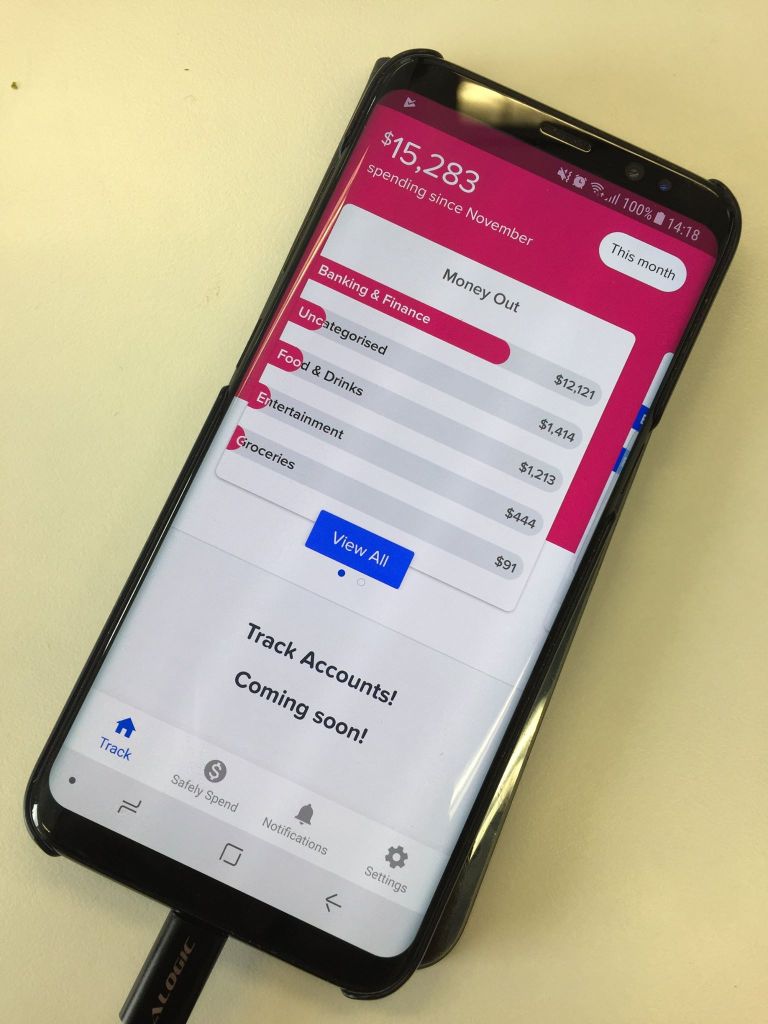

Pocketbook

This little Aussie StartUp has over 800,000 users which is 2.77% of the Australian population and was acquired by Zip! Code for – they are great at helping a lot of people budget. But they aren’t just on my list of best budget apps in Australia because of the number of people using the app, Pocketbook integrates with 24 different Australian banks (yes, including the major four if you’re still haven’t seen the light and switched). This means you don’t have to manually enter all your expenses onto the app, the app will sync with your bank accounts and credit cards to track where your money is actually going.

This might sound scary to you if you really aren’t sure where all your money is going, but at the same time it will give you the knowledge and therefore power to change your spending habits.

Plus, you can input cash transactions like coffee or a beer and add additional details like photos of receipts, bills, and invoices to help you track literally all your transactions and make your life easier at tax time.

Goodbudget

This app is a modern digital version of the envelope budgeting method, where the cash for each month’s expenses is taken out and divided into envelopes for each budget category – for example, groceries, transport, eating out or rent. Or if you’re familiar with the Barefoot Investor then he calls them buckets – same method.

The simple concept is that you stop spending money from a category/envelope/bucket once you’ve emptied it, or even before then if you’re really disciplined.

Goodbudget helps you to stick to those budget limits. Rather than discovering that you overspent when it’s too late, you can plan your spending beforehand and only spend what you have.

This app is also great for couples to manage the combined household budget and check know how each partner is tracking because you can access it from multiple devices.

The free version allows you to create 20 envelopes plus access the app across two devices. The paid version is $7 per month or $70 a year and for the paid version you get unlimited envelopes and accounts plus access to the app across five devices. An extra bonus of the paid version is that your data and transactions will be available for 5 years which is fantastic to see how your money management and goals have been met year-on-year. That kind of insight is invaluable!

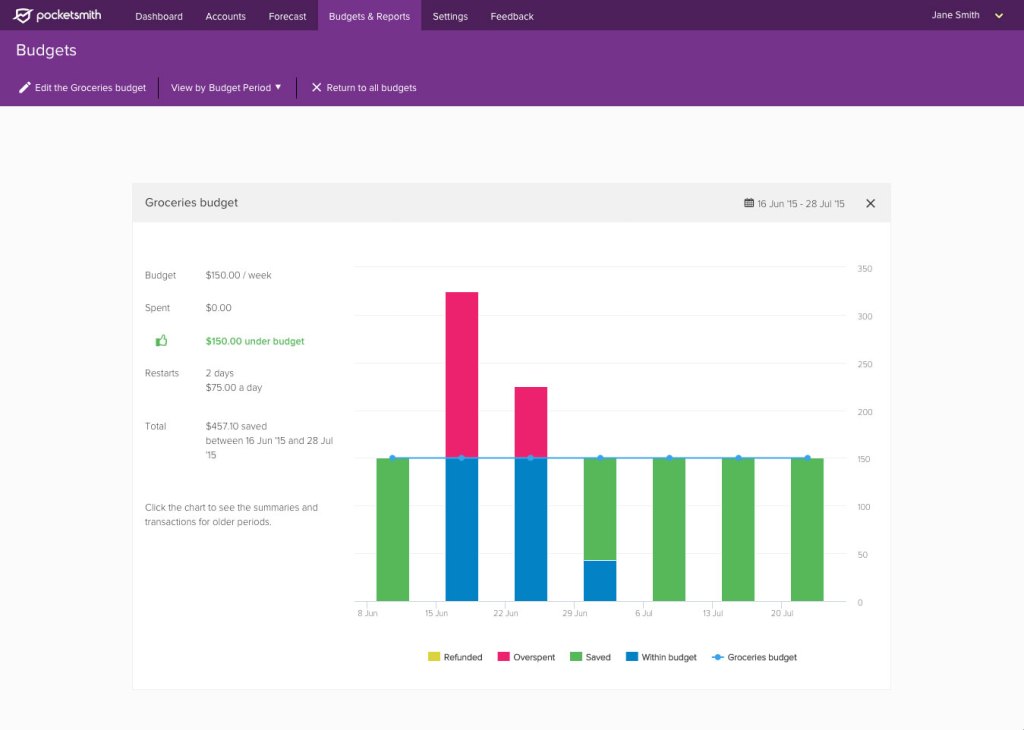

PocketSmith

PocketSmith was created by our Kiwi neighbors I’ve still included them in this list of Best Budget apps in Australia because they are very popular here. PocketSmith integrates with 165 different Australian banks (didn’t know we had that many banks here? Well we actually have over 400 but that’s an article for another day). Again, like PocketBook this means you don’t have to manually enter all your expenses onto the app, the app will sync with your bank accounts and credit cards to track where your money is actually going.

This app has a couple of really fancy features that may make you realize the value in a paid budgeting app. First up, if you have a small business and make transactions that you then need to log in Xero – you can link your Xero account to PocketSmith and send the expense over to Xero (amazing!).

Next up, a feature I have only ever seen in clunky budgeting software built by software engineers for software engineers in the early 90’s – the ability to run ‘What-If’ scenarios on your financial projections. What this means is that you can have all your known bills entered to help you make sure there is enough money to pay them all on time but also, you can then run a ‘What-If’ scenario to see whether an impromptu $15,000 trip to Scotland is going to cause you financial stress once you return or not.

The free version requires you to manually import all your expenses. The paid version imports your transactions for your bank accounts and credit cards and starts from $10.95 per month with 10-year projects or you can get a more expensive paid version for $21.95 per month with 30-year projection capabilities.

So those are my top five budget apps that I suggest you check out, to save you having to trawl through endless internet searches looking for the right one! Open the links above and have a look for yourself, you’ll soon know which option is best for you.

Have fun!